With global energy demand continuously on the rise, fossil fuels alone will not be sufficient to meet the demand. Alternative energy, which is defined as any energy source other than fossil fuels, is gaining interest. This segment addresses a lot of concerns linked to fossil fuel usage, including carbon-dioxide emissions, climate change, and other harmful effects on the environment. Companies operating in the alternate energy space include business operations in products, services, and research associated with alternative energy, and in production and supply of alternative energy. As development in technology continues amid high fluctuations in oil prices, this sector is expected to see high volatility.

This article discusses the top alternate energy stocks that look promising for 2015. The list is in alphabetical order with market capitalization, revenue, relative past performance for last one year, a brief description of primary business streams, and future prospects. Sun and wind rule the popularity list, while others forms of energy like biomass, geothermal, hydroelectricity are limited due to operational constraints and less efficiency. (See related: Why You Should Invest in Green Energy Right Now)

- Canadian Solar Inc. (CSIQ): Founded in 2001 and headquartered in West Guelph, Canada, Canadian Solar is in the business of designing, developing, and producing solar cells, solar wafers, solar modules, and solar power products. It operates globally with a presence in Canada, the US, China, Germany, India, and Japan. Its market cap is around $1.9 billion and revenues are $914.38 million. Investors looking for investments in a global solar energy business will find this company a good fit.

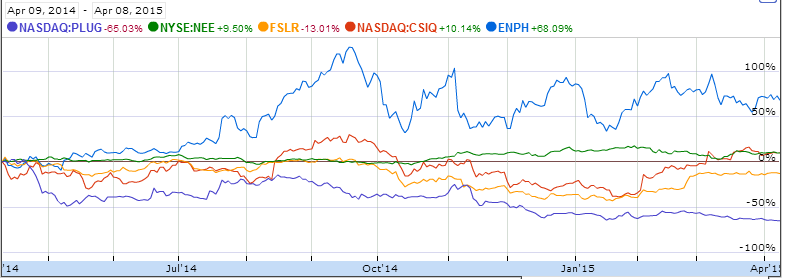

- Enphase (ENPH): Founded in 2006 and headquartered in Petaluma, California, Enphase Energy, Inc. is in the business of developing and designing of microinverter systems for the solar photovoltaic industry internationally. Associated businesses include the Enlighten software portal that acquires, processes, and relays information that helps customers to monitor and manage their solar power systems. Enphase has a market cap of $537 million and revenues of $105.21 million.

- First Solar (FSLR): Founded in 1985 and headquartered in Tempe, Arizona, First Solar, Inc. is in the business of designing, manufacturing, and selling photovoltaic solar equipment and solar power systems through its two segments: components and systems. It has a market cap of $5.98 billion and revenues of $1 billion. It operates globally, serving commercial and industrial clients.

- NextEra Energy (NEE): Founded in 1984 and headquartered in Juno Beach, Florida, NextEra is in the business of renewable energy generation from sun and wind. It operates in the US and Canada through two subsidiaries: Florida Power & Light Company and NextEra Energy Resources, LLC. The company offers wholesale and retail electrical service to almost five million customers and owns generation, transmission, and distribution facilities to support its services. Its market cap is around $46.43 billion and revenues are $4.664 billion. Investors looking for a company with operations in both wind and solar space will find this company a good fit.

- Plug Power Inc. (PLUG): Founded in 1997 and headquartered in Latham, NY, Plug Power provides technology for the alternative energy sector. Its business operations are in “design, development, commercialization, and manufacture of fuel cell systems for the industrial off-road market.†Its market cap is around $454.32 million and revenues are $21.45 million. Although ranking lower in terms of market cap compared to the other stocks mentioned, Plug Power is a leader in fuel-cell technology and one of the pure technology players in the alternate energy space.

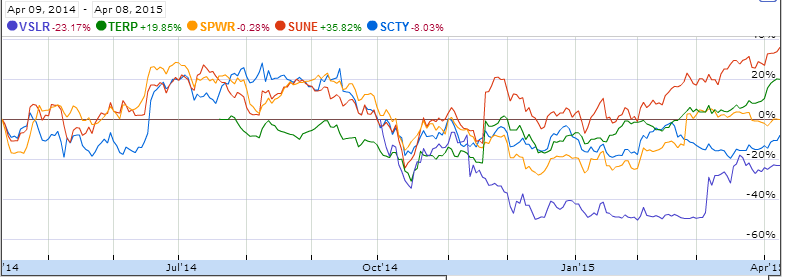

- SolarCity Corp (SCTY): Founded in 2006 and headquartered in San Mateo, California, SolarCity is designs, installs, and sells and leases solar systems for commercial and residential customers. It also operates the sale of electricity that is generated by solar systems. Other businesses include energy storage, charging services for electrical vehicles, home energy evaluations, and energy efficiency upgrades. The company’s market cap is around $4.81 billion and revenues are $71.81 million. With a wide variety of businesses based on solar energy, this company is firmly placed in the list of top alternative energy stocks.

- SunEdison, Inc. (SUNE): Founded in 1984 and headquartered in Maryland Heights, Missouri, SunEdison Inc. is into renewable and solar energy. Through its three segments (solar energy, semiconductor materials, and TerraForm Power), it is in the business of developing, manufacturing and sales of silicon wafers, photovoltaic cells, and other energy solutions. It has a market cap of $6.47 billion and revenues of $610.5 million.

- SunPower Corp. (SPWR): Founded in 1985 and headquartered in San Jose, California, SunPower Corp. is an energy services and technology company. Its customer base is spread across residential, industrial, and utility segments with operations in North and South America, Europe, the Middle East, and Asia Pacific. Its product range includes ground mounted and rooftop solar systems, panels, and inverters. Its market cap is $41.7 billion and revenues are $1.17 billion. This company offers a good investment option with business serving a diversified customer base globally.

- TerraForm Power (TERP): Founded in 2014 and headquartered in Bethesda, Maryland, TerraForm Power Inc., owns and operates the contracted clean power generation assets of SunEdison, Inc. and other entities. It is a wholly-owned subsidiary of SunEdison. The company operates wind and solar power plants in Canada, Chile, the UK, and the US. It plans to expand further into wind, geothermal, natural gas, hydroelectricity, and hybrid-energy solutions, which can make it a good long-term good investment option. Its market cap is $4.47 billion and revenues are $42.57 billion.

- Viviant Solar, Inc. (VSLR): Founded in 2011 and headquartered in Lehi, Utah, Viviant Solar follows the distributed model for selling electricity generated by a solar energy system installed at customers’ locations to other residential energy customers, based on contract pricing. It operates in Arizona, California, Hawai’i, Maryland, Massachusetts, New Jersey, New York, and Utah. Viviant also offers photovoltaic installation software products and equipment. It has a market cap of $1.3 billion and revenues of $6.86 billion. Investors looking for a US-focused solar energy company might find this a good fit.

The Bottom Line

The Bottom LineThe alternative energy sector has seen a few challenges in last few years and growth has not met expectations. For example, the US Department of Energy’s loan program to fund solar industries had initial failures with companies like Solyndra and Abound Solar going bankrupt. However, the program was reported to break even in December 2014, showing signs of success and justifying the claims that supporters of alternative energy will benefit in the long-term. Moreover, the sector continues to evolve and is expected to see good growth in the mid- to long-term. (A good number of companies listed above are less than a decade old.) One can also explore alternate energy ETFs as an investment option.

.png)

“Basically we’re doing it from the ground up. We pounded all the poles in the ground and we’ve also made all the rack systems and now we’re at the point where we straightening their raise and lay the panels on,†said Foreman Bill Dostellio.

“Basically we’re doing it from the ground up. We pounded all the poles in the ground and we’ve also made all the rack systems and now we’re at the point where we straightening their raise and lay the panels on,†said Foreman Bill Dostellio. According to Vice President of University Communications Dan Anderson, the crew is building a 4,500 megawatt system. This will give electricity to about 415 homes.

According to Vice President of University Communications Dan Anderson, the crew is building a 4,500 megawatt system. This will give electricity to about 415 homes.